Options Trading Is A Sexy Thing To Do

Options trading is a sexy thing to do. My fascination with easy money has taken me from ebay listings, to a Pan Am print on demand website, to the stock market, to baccarat, and now to options trading. Not that I’ve given up any of the other things for options trading, but they are called “options” for a reason. I’ve made a little money with my AMC stock and I’m pulling some of it out for my baccarat bank. I’m a very busy woman.

As for options, it’s amazing more women don’t talk about them, because options are exactly what we like. “You want to eat where? They didn’t refill our water glasses last time. What about that new place across town? It’s only five miles from that other place we liked three years ago if we don’t like the new place. I brought my other shoes just in case.” Don’t ask just in case what. You don’t want to know.

Forex is next to learn, I suppose, but my brain may be fried by then.

I checked out an ebook on options trading, answered some questions about my personal proclivities on Robinhood–like how I really hate to lose money–and when I’m ready to try a trade, I’ll be all set. I’ve been buying and selling stocks on Robinhood for a few years now. I’m almost not an expert in stocks, but I need a few more years to get to that level.

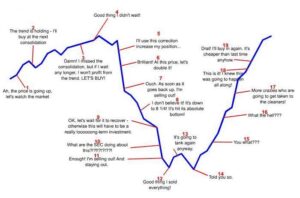

Everyone can get rich following what I do in the stock market. Just do the opposite. I buy high and sell low, or I buy at the right time, but as soon as I do, the stock goes down. If you want to drive a company out of business, that’s your go to way to do it. Just encourage me to buy the stock and it will flat line in an hour or two.

As for the options trading book, that $100,000 house showed up. It shows up everywhere. Whenever I read about any subject, that house inserts itself into the conversation as some sort of iconic example of, “Look at me, I’m so easy to understand, even though no one has ever SEEN a house at this price.”

The author uses the house to explain the basic concept of an option trade. It goes like this: Let’s say you’re strolling down the street and you see a house you want. It overlooks the beach in San Diego and it costs–wait for it–$100,000. Well, dang. That’s a real good price and it sounds so familiar. Maybe that’s what your parents’ first house cost in 1969, or maybe you saw this house in your Real Estate for Math Challenged Dummies book.

You knock on the door pretending that you have Girl Scout cookies, which offer many options for all taste buds. After the owner falls for that lame trick and invites you in, you ask her to sell you an option to purchase her house in three months at $100,000. However, you will be under no obligation to buy it in three months at any price. That’s option trading.

What does this beleaguered and cookie-less owner get out of the deal?

You pay the owner $3000 to do this for you. Even if the house goes up in value to $120,000, too bad, the owner has to sell it to you at $100,000 because this is the Example House and its base price is $100,000.

If you decide not to buy this iconic house built by Frank Lloyd Wright during his Beach Bum Period, you are out the $3000. The owner gets to keep that money and is free to find some other sucker to give her $3000 to keep her house off the market.

It could drop in value as well. But what does this owner care? She’s too busy selling options in it. In between, she rents the house out as an AirBnB.

The house might be worth $90,000 at the end of the three months, and you, the savvy options trader, are not obligated to buy it. However, if you wasted your house hunting time lounging on the beach and now you have nowhere to live, go ahead and exercise your option. You need a place to bunk anyway, and since you were already under water–so to speak–all summer, you might as well be under water in your mortgage. Plus, you already put $3000 into it.

At any rate, $90,000 is too difficult a number to work with, so the options trader, who is now strapped for cash, is instructed to burn the house down and collect the insurance. That’s an option, too.

The sexy part of options trading, besides the promise of riches, is the lingo. My forehead got a little dewy perusing it. Besides the Puts and the Calls, options trading has an Iron Butterfly, a Butterfly Spread and a Calendar Spread, because if firemen get a calendar, so should options traders.

It has a Married Call and a Naked Call, which are both in the same room, but keep it on the down low. When the money starts flowing, options get really involved. Straddles and Strangles are mentioned. There’s a lot of role playing going on with that options trader, who couldn’t be bothered to find a job, but can indulge in kinky stuff in the office of his new house.

With the Strangle strategy, you are “out of the money” trading, which makes sense since you are clearly being mugged, or you have forgotten your “safe” word, but you are supposed to use a Protective Collar, which shows some social responsibility.

There’s also an Iron Condor with an “at the money” Straddle. This doesn’t bear thinking about, and I’m too busy fanning myself with the deed to my $100,000 house anyway.

Hey Gigi, It may be a pure coincidence as I m just about to try my luck in options next week and this post strike me , I can relate all the things you written about stocks, I have been buying and selling stocks for a few months now. Hope all is well on the other side of the world. Love, Majo

Majo! How the heck are you? Doing well, I hope. That is a coincidence. Let me know how it goes for you, okay?

of course, Gigi.

Great! Good luck with options!

hi Gigi, how is everything, as my promise of giving feedback about options trading i m here again, it’s been almost four months now since I started, still going in loss not huge, not a right moment to say this but i m getting the confidence of can generate 2%monthly consistently, well that’s not yet happened but somehow i m at that point to predict it confidently, love you Gigi

Wow, Majo. Good for you! I only tried it once. I have to study it some more and maybe try it again. Good luck with that! Two percent is awesome!

I’ll buy some from you, Mary, but here’s the deal: I will buy them at $2.50 a box in three months, for a total of $100,000. If the price of cookies goes up, too bad, you gotta sell me the cookies at $2.50. I will give you this bottle of Coke as a premium to do that for me. Yay! We’re rolling now!

But the cookies have to last long enough to complete the deal. Got me doubts about that.

Remember, don’t bet more than you can afford to lose. Good luck!

Yeah, cookies disappear faster than money in the stock market. Thanks, Mary!

I think I’ll stick with the Girl Scout cookies. Sounds safer and sweeter.

Ah…Options Trading…Broker wins whether you win or lose.

But if you have money to blow, Options is the way to go!

Well, it’s on Robinhood and they don’t charge any commission. So you’ve done this and it didn’t work out for you? I will be very careful, I promise. I’m still reading about it. Don’t understand it yet. I wish I could pick your brain!

You are truly crazy!

My head is spinning.

Let me know your next stock pick.

I’ll borrow to it, sell it, then buy it back when it loses value, and repay the lender at the depleted stock price.

Get it?

I don’t either.

Yeah, that’s my understanding of how it works, too. Haha! Like going to a casino. I usually just drop my money at the cage and then wander around crying.

This was just too good. To the point in a very funny way. One of your best, I think, if not the best. At least since Jet Fuel.

Man, I gotta top Jet Fuel one of these days. I like Information and Comfort Zone better, but you are entitled to your opinion and mine. Thank you, David! Wait until I start writing about The Country Life and wearing tweeds and brogues and carrying an umbrella on my walks.